After many requests, I have decided to start a series exploring my methods on money management.

For the following examples, we are assuming a new month consisting of 4 weeks, with a fully stocked kitchen. This is the first of a series of posts that will walk through a variety of topics including budgeting, how to save grocery shopping, and other household tips! Let's get started.

So, for me, everything revolves around cutting costs anywhere and any way you can. Before you can do anything, you have to create a budget.

1. Create a Budget with a Bill Plan

Obviously, if you have a system that works for you, use that! If not, here’s how I do my budget, though admittedly, at the moment, it’s more of a “Bill Plan”. For other ideas on budgeting and how to create one perfect for you, check out these ideas on Pinterest! I personally use a series of note cards to keep up with my bills. One, because they're easy to slip into a wallet, zip pouch, or any container, and two, because I have an over-abundance of note cards in my stockpile.

For me, I use one card per week. One side will have this week's bills listed on the card. This week, we're a little light on the bills due--which is good! If you know you need to get gas or groceries, you'll add it in here as well (we'll talk a little bit more on how to get that grocery bill down!). Notice how things that automatically come out I write "Auto" next to, so I know this one requires no action on my end. I've also included due dates so I know exactly when something needs to be done. For extra comfort, you can "high ball" these bills. So, for example, say I have an outstanding credit card bill, or car payment. Instead of the exact amount or minimum due, I budget for, say $5 extra. This way either a) I have budgeted for the bill entirely, b) paid off a little more than necessary, or c) earned myself a credit towards next month's bill. The last option is especially helpful if you know funds may be a little short next month, or there's extra bills coming up.

|

| For privacy reasons, I've left off our private bill amounts. |

Now, on the other side is where you'll run your weekly budget. I include everything that I have in the bank at the moment of doing the bill plan. (If, for example, you cash your checks immediately or do cash envelopes instead of using your bank cards, include that in your bill plan, or modify as needed.) '

So, let's do some examples! (Disclaimer: I came up with these numbers off the top of my head!)

So, let's write down our bank amount, plus any cash. If using a cash envelope system, it might be a good idea to just account for these bills as "paid" and don't even add it in here. It will save space and confusion. Okay, for my example I'm going with $475 in the bank, plus $340 cash for a total of $815. We'll take away $12 for Netflix, because even if it requires no action from me, it still comes out of my budget. Then (again, make-believe numbers), let's say rent is $610. So, when all the math comes through, we're sitting at $193 left in the bank--I call this "Carry over". Now is a good time to add that as you pay each bill throughout the week (if for some reason you cannot all at once), mark the amount on the bill plan some way, so you know it is dealt with. Also include when you took care of it and, if you use checks, it's a good idea to mark the check number on the bill plan as well. I also go ahead and mark this same information on the bill envelope itself.

(If anyone is interested in a post on organization, let me know!)

SO. Here's a look at our hypothetical budget for this week.

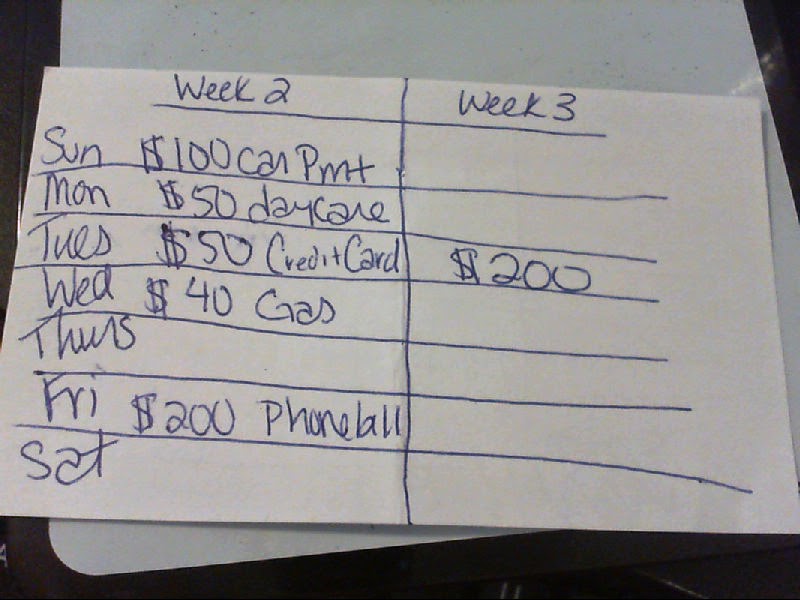

Now let's say we're back to next Monday, and now we have four more bills to make: A Credit Card Bill for $50 minimum balance, a Car Payment of $100 minimum, Phone bill of $200, and we need gas! Plus, daycare costs (for me, I pay daycare every other week, so this example works for me especially) of $50, due Monday.

So, we still have that $193 "Carry-Over" from last week. Let's say there are two paychecks coming in for a combined total of $400 (we'll look later on how you can "predict" how much your income would be if you--like myself and many, many others--work variable hours with hourly wage). So we have the $193 plus $300, for $493 total.

Now, we have a combined bills total of $400 (that's paying minimum balance) plus our gas budget (which will vary from person to person, region to region. I average $40). So we have $493, a total of $440 worth in bills and we need milk and bread (staples in my household!). These grocery-staples must be accounted for in our bill plans as we need them (for example 1, we assumed well-stocked pantries). So add a $20 grocery budget. Later on, we'll discuss how this number is so low and how to cut your grocery bill.

Bills are up to $460, we have $493. Cutting it close, eh? Some weeks, (this time speaking from experience), you may not have enough to make the ends meet. We're going to assume for this that you also have a utility bill next week for $200, and you know that you won't be able to make that with a cut in hours you got this week. So let's plan ahead (and I can show you my notations and ways to prioritize this clump of bills so you don't drown in debt).

Here's a look at a mock Bill Plan for this example's weeks two and three. This picture is showing it as a type of weekly planner--which you can use for keeping track of your bills as well.

Here's where we prioritize. Daycare and Gas have to be paid, so take that out first, so we have $403 remaining. Let's also take out our $20 grocery budget, because that can't be put off either, so that makes $383. This leaves Car Payment, Credit Card, and Phone Bill due for this week, and Utilities next week. Here's a look at our budget so far.

We're at $383 for the week. Before we continue allocating money to different areas of our budget, let's get a look at how much we should get on this week's paycheck.This is especially helpful for those (like myself) who work hourly-wage jobs that vary. We'll look at two options: one standard work week, and one with overtime.

So, we need to figure out what we will get for (Week 2) Friday's paycheck, which (usually) covers the work from Week 1. Let's say we work 30 hours, making $8 (which, for TN, is right above the minimum wage of $7.35).

So that's 30 X 8 = $240 before taxes. The amount of taxes you need to take out will vary; I started out with my budgets taking out 15%. In this amount you need to account for any other deductions that come from your paycheck. For example, I have union dues as well as a $1 donation to United Way that comes out of every paycheck. This brings my deduction to about 20% or so, and I've found that this percentage works for me. It takes a little trial and error here.

So we set up a proportion to take out the percentage. X over the your gross amount, then equal to 80 over 100. (The second numbers are coming from the deductions; to make it easier and quicker to see your net amount--what you'll actually be getting--subtract your deduction amount from 100. So for this example, 100% minus 20% gives you 80%, shown as 80 over 100.)

Bring out our calculators, and we'll do our cross multiplication. 80 X 240 = 19,200. Set that equal to 100x.

19,200=100x

Divide to solve for x.

192 = x

So! We will get $192 back for this paycheck we receive on Friday of Week 2. For the purposes of budgeting, it's always a good rule to lowball your expected income. Meaning, yes, we mathematically used those algebra skills (that you thought you'd never use) to find out what we'll get back. But what if you worked slightly less than 30 hours? Maybe your percentage is slightly off? To cover the "what if"s and make sure we have enough bills, you're gonna want to account for slightly less income. So for our budget, let's say we have $180 coming in with this paycheck.

Now, what do we do with overtime? We will basically walk through the same steps as above. First, let's define overtime. For the average part-time hourly worker, this is anything over 40 hours, and is usually paid as "time and a half". This means, if we use our previous wage of $8 and hour, you get paid the $8 plus half of that per hour. Making your overtime wage $12 and hour--pretty freaking sweet.

So let's say for our second paycheck coming in on Friday of Week 2, we had worked 46 hours throughout Week 1.

So, 40 of these hours we made at our regular wage of $8, bringing us a gross total of $320. The other 6 hours worked were at the overtime wage of $12 an hour, bringing us to a gross total of $72. Add these two amounts together to get our total gross income for this week.

Now, we'll walk through those deduction steps to take out 20% of this total. For this paycheck we will have $313.60 in "take home", or net pay. Don't forget to lowball your income so we'll have roughly $300 to work with on this paycheck that we will receive Friday of Week 2.

(Note: These examples are based on a two job income, so adjust these accordingly. Either way, this example will show how to account for overtime. When we go back to our Week 2 Bill Plan and Budget, I will be combining both paychecks that we just worked with.)

So let's review what we're working with. In this example, it is the beginning of Week 2, and we are facing quite a few bills. We have $383 left after allocating money for the absolutely-cannot-wait-bills. We have a $100 car payment due on Sunday, a $50 minimum balance on our Credit Card due on Tuesday, a $200 Phone Bill due on Friday, and a $200 Utility bill on Tuesday of Week 3. We can expect a total of $480 of income on Friday of Week 2. We're wanting to pay bills up to get out of debt faster, as well as have a little bit of carry over for next week.

So, let's go ahead and pay the Car Payment of $100, and the Credit card bill. We've already determined we should have enough for both the phone bill and the utility payment for next week. So let's pay up the Credit card bill---send $80 there, and then the Car Payment of $120 (again, paying up. One of the easiest way to get out of debts--pay as much as you can when you can). That leaves us $183. Now, we do have a little extra! Hide some away into a savings account, and

DO NOT touch your savings until it saves you from drowning. Want to get a pizza? Make it. Want to buy that cute new shirt? Nope. DO NOT TOUCH YOUR SAVINGS.

Here's what we're looking on Thursday of Week 2.

So when Friday comes around you add the $108 to your income of $480. You'll pay your $200 Phone bill, the Utility bill for Week 3, and have $188 leftover. The cycle continues.

What if you need to split payments?

Let's say you've come up short one week; all resources are depleted and you absolutely have to pay your phone bill or they're gonna cut it off. Trust me, I've been in this situation. Here's my advice:

Call the phone company (or whichever biller may be causing you problems). Offer to pay whatever amount you can. Let's say, for our example of a $200 phone bill, we can only pay $75 this week for whatever reason. Tell the biller how much you can pay, and pay it. You need to build a bit of trust with these people. Set up a payment arrangement with them for your next payment on that bill. Every week until that bill is paid off, make it your number one priority bill.

I keep all of my bills in an organizer on my desk; every time one comes in I mark the due date and the amount due. Every time I pay the bill, I mark how I paid (debit, credit card--HUGE no, no-- or check with the check number). If I have to do a partial payment, mark each partial payment, payment method, and the new amount due. Highlight each partial-payment bill so it stands out to you next time you sit down to do your budget and bill plan.

Doing Bill Plans allows for me to readily see what needs to be paid for first, ensuring I don't overspend, and I don't get service charges or late fees. Another way I keep up with these amounts and upcoming due dates are through two apps on my phone (both of which have website components). I use Manilla and Mint to keep track of my bills, spending, and budgets in general.

Since this post is so long, and I'm sure there are tons of questions, comments, etc. about the subject, I am turning this into a series on Money Management.

As always, if you've enjoyed this post, let me know. Feel led to support me in someway? Check out my GoFundMe. Don't forget to pass this post on to whoever you think can benefit! Until next time.... What Money Management information, tips, suggestions would you like to see? Sound off in the comments below!